Stock Market Update Wednesday February 19, 2025

- AlgoTradeAlert

- Feb 19

- 4 min read

Stock Market Update Wednesday February 19, 2025 Stocks rose slightly, with the S&P 500 gaining 0.24% to reach a new record closing price. Most of the trading session showed modest gains, but the last hour experienced some volatility, especially as Palantir (PLTR) and defense contractors declined due to worries about possible cuts in Pentagon spending. The Nasdaq 100 (QQQ) saw a minor increase of 0.05%, whereas small-cap stocks lagged behind, with the Russell 2000 (IWM) falling by 0.4%.

On the corporate side, Merck (MRK) and Johnson & Johnson (JNJ) were among the day's best performers, while Salesforce (CRM), Intel (INTC), and Palantir (PLTR) experienced significant declines.

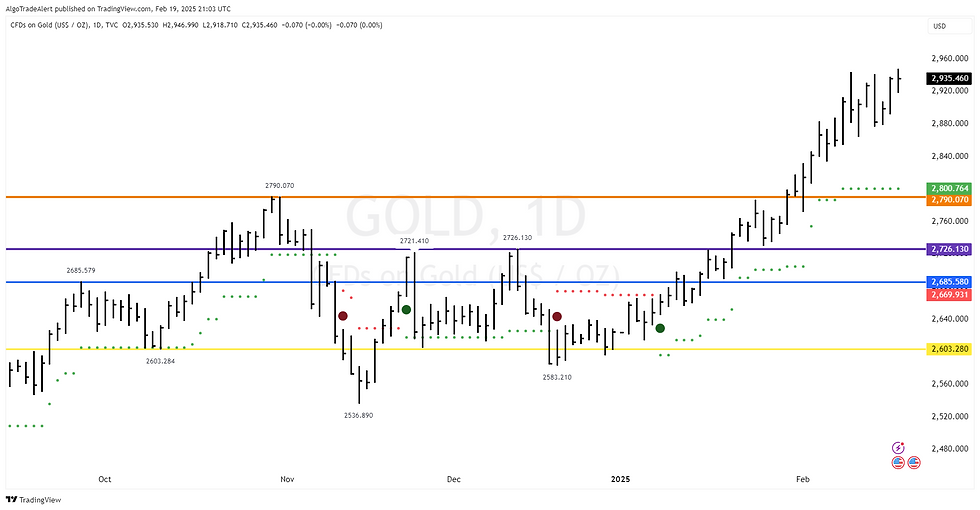

Away From Stocks: In the bond market, Treasury yields decreased by 1 to 4 basis points. WTI crude oil prices remained steady at $72 per barrel, while gold prices rose to $2,933 per ounce. Bitcoin stayed close to $96,000, and the VIX was just above 15, indicating low volatility.

Our investment strategy follows a disciplined and cautious approach, avoiding risky practices like short-selling and market timing, which can create significant volatility and uncertainty. Instead, we focus on selecting stocks with strong fundamentals and wait for buy signals from our proprietary algorithm. For professionals aiming to enhance their returns, our unique algorithm and carefully crafted newsletter provide a clear and objective framework for navigating market conditions. Successful investing relies on executing trades accurately—understanding when to enter positions, and determining the best direction to allocate capital for optimal risk-adjusted returns.

Take charge of your investments in 2025 by unlocking access to the same daily insights banks and hedge funds rely on to navigate markets. This Friday February 21, 2025 will share 2025 Market Outlook.

All-Time SPY ETF Closing High Premium Edition For Free

Market Sentiment and Forward-Looking Indicators:

Several important market indicators suggest a positive outlook for stocks. The First 5 Days Barometer, which measures market performance during the first few trading days of the year, has historically shown an 82% success rate in predicting positive returns for the entire year. Similarly, the January Barometer, which assesses the market's direction based on January's overall performance, has an even higher success rate of 89%. These trends indicate a strong likelihood of continued market growth throughout 2025.

Retail Sentiment Collapse as a Contrarian Buy Signal:

A sharp deterioration in retail investor sentiment, as measured by the AAII Bull-Bear Sentiment Indicator, has historically served as a reliable contrarian signal for strong forward equity returns. When AAII net bullish sentiment (% bulls minus % bears) falls into the bottom decile, it indicates widespread investor pessimism, often coinciding with market inflection points.

Historical data supports this contrarian view:

When sentiment ranks in the 90th–95th percentile of bearishness (net bullish sentiment between -24% and -16%), markets tend to rebound strongly in the following months.

The 6-month forward return averages +7.9%, with a 78% win ratio.

The 12-month forward return averages +17.7%, with an even stronger 84% win ratio.

This pattern suggests that deep pessimism among retail investors is often a precursor to strong equity market performance, making periods of extreme bearish sentiment a compelling opportunity for contrarian investors to add risk exposure.

ISM Manufacturing Surges Above 50: A Catalyst for EPS Growth:

The January ISM Manufacturing Index rose above 50 for the first time in 26 months, indicating a shift in economic momentum. A reading above 50 suggests expansion in the manufacturing sector, which typically boosts earnings for small-cap stocks and the broader market.

This is especially beneficial for small-cap stocks, as manufacturing recoveries often enhance revenue and profit margins in cyclical industries. Historically, when the ISM index moves from contraction to expansion, small-cap stocks experience significant EPS growth compared to large-cap stocks.

Additionally, a robust manufacturing sector supports overall EPS growth. Increased production fosters corporate investment, hiring, and supply chain demand. Given the ISM index's track record, this shift hints at accelerating corporate earnings in the coming quarters, creating a favorable outlook for stocks.

Economic Tailwinds Supporting Market Strength:

Inflation is lower than expected, easing fears of aggressive Federal Reserve actions. This environment reduces the need for interest rate hikes, benefiting riskier investments.

Exaggerated tariff concerns have weakened the U.S. dollar, which aids multinational companies by boosting export competitiveness and increasing foreign earnings in dollar terms.

Strong performance in cyclical sectors signals investor optimism for economic growth, enhancing confidence in expansion.

With the next FOMC meeting not occurring until March 19, there will be six weeks of stable monetary policy, reducing short-term market volatility and allowing for stock gains without immediate Federal Reserve interventions.

Bottom Line:

Tuesday January 21, 2025, our proprietary algorithm has issued a Buy Alert for the S&P 500 SPY ETF and the Nasdaq 100 QQQ ETF. These two indexes represent two of the most significant components of our portfolio strategy. With this development, we now have Buy Alerts active across all five major indexes, signaling broad-based market opportunities. On January 17, 2025 Our proprietary algorithm has issued buy signals for three major ETFs: the S&P 500 Equal Weight ETF (RSP), the Russell 2000 ETF (IWM), and the Dow Jones Industrial Average ETF (DIA). Despite uncertainties, the macroeconomic environment shows positive signs: a supportive Fed, improving manufacturing data, and easing inflation. As earnings season progresses and more economic data is released, markets may stabilize, leading to renewed optimism. Monday January 27, 2025 the U.S. Dollar Index (DXY) triggered a sell alert from our proprietary algorithm. BlackRock Inc. (BLK), a key market leader, triggered a buy signal from our proprietary algorithm today. The January Barometer, which suggests that January’s market performance sets the tone for the entire year, showed a positive start. Since 1950, when January has been positive, the S&P 500 has averaged a 19% gain with an 89% success rate. The January ISM Manufacturing Index increased above 50 for the first time in 26 months, signaling a change in economic momentum. A reading above 50 indicates growth in the manufacturing sector.